After several years of eye-popping growth, TikTok has elbowed its way into contention as a major social platform. As expected, this has led to huge interest from marketers eager to nurture relevancy and grow market share amongst its 800M-odd monthly active users. To date, the lion’s share of that interest has centered on brand activation and viral organic distribution through its network of creators. Lesser known is TikTok’s emergence as a performance marketing channel for mobile app and direct to consumer marketers.

Likely learning from Snap’s stumble and subsequent renaissance with performance advertisers, TikTok has prioritized direct response early and aggressively. In under a year, the team has built a campaign management platform with coverage across many of the targeting, bidding, and optimization mechanics that performance marketers have come to expect. Mobile marketers specifically will find a toolkit resembling Facebook circa 2017-2018, with a well-built app install product offering and downstream event optimization in its early stages. Advanced marketers also enjoy access to a surprisingly robust campaign management API for tooling and automation.

That said, advertisers expecting to copy and paste their Facebook playbook onto TikTok and get Facebook-like results are in for a rude surprise. At Headlight, we’ve been fortunate to spend the last six months in TikTok’s self-serve beta helping brands across a number of verticals reach profitable scale. We’ve taken the opportunity to break down and share key metrics, lessons learned, and best practices for advertisers who are curious about adding TikTok to an ROI-focused media mix.

Quantifying the Opportunity

For performance marketers, TikTok’s value proposition right now is cost-efficient diversification: like Snap, it offers a release valve for exponentially rising acquisition costs on Facebook. Driving that is a gulf between supply and demand as ad dollars lag user growth: despite massive and accelerating DAU growth, it’s been estimated that less than 4% of marketers have invested in the platform.

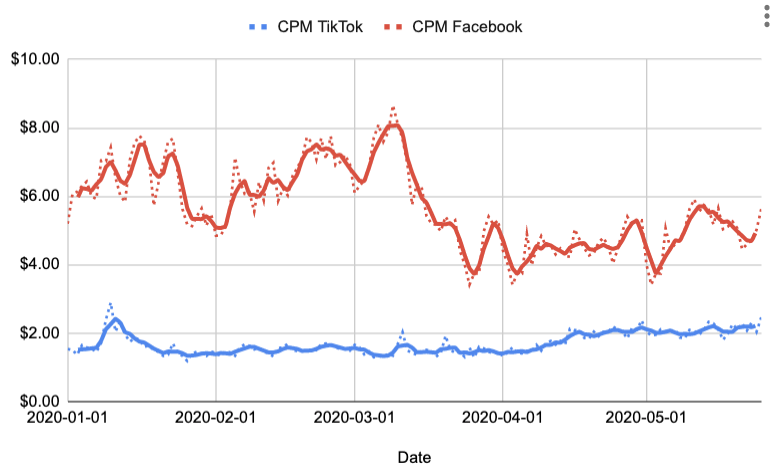

We’ve observed this gap directly in performance metrics across our client base at Headlight. The graph below is a plot of impression costs on TikTok versus Facebook over 2020 for a subset of our clients. Prior to COVID-19, Facebook CPMs were consistently 300% to 400% higher than TikTok. And for advertisers focused on narrower, high value user segments, we’ve seen deltas stretch to almost double that amount. Notably, we saw no impact from Coronavirus on TikTok CPMs.

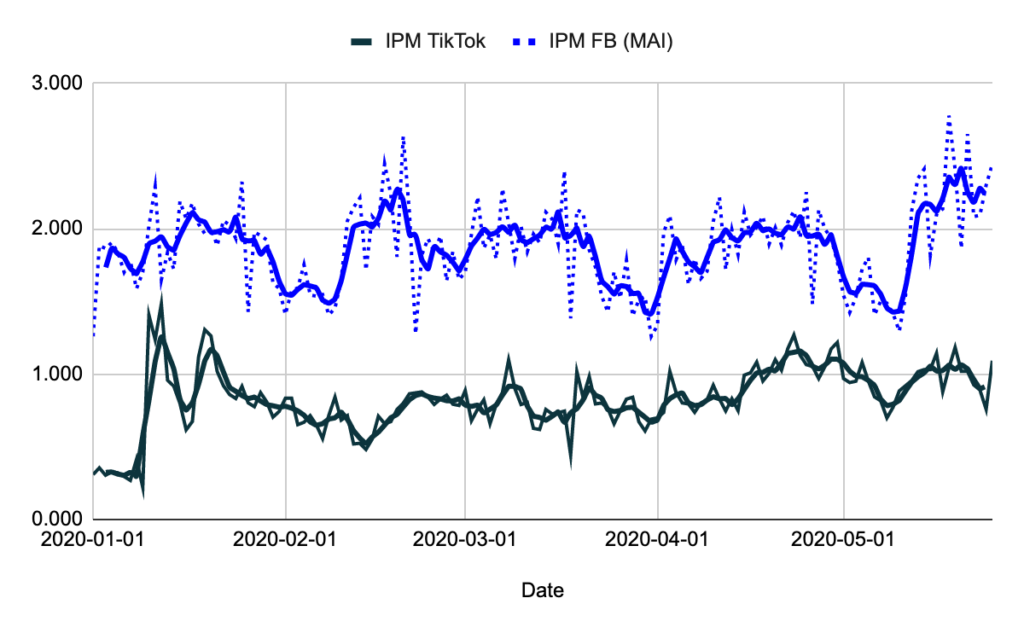

What about downstream conversion rates? Predictably, Facebook retains a substantial advantage. With an SDK and pixel footprint collecting performance data from nearly every meaningful consumer internet property and over a decade of ad product innovation, Facebook is unrivaled in terms of targeting capabilities. The below plot comparing app install conversion efficiency across the two channels for one of our clients is broadly representative, with Facebook generating roughly two times the number of installs per thousand impressions as TikTok:

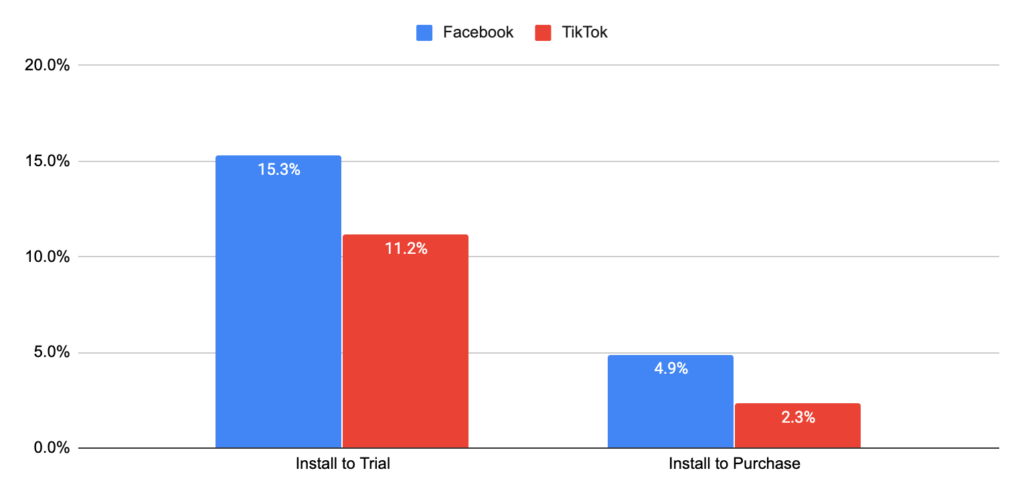

In terms of retention and monetization, Facebook outperformance persists although the magnitude depends on product vertical, scale, and campaign parameters. Generally speaking, we tend to see Facebook outperform TikTok by 30-50% across typical measurements of user quality. This graph below compares Facebook and TikTok average trial and purchase conversion rates over 2020:

A big factor is that purchase optimization for TikTok is still a whitelist beta product. Qualification takes place at the ad set level, with TikTok requiring at least twenty events per day for eligibility. This is difficult to accomplish for some advertisers without either reducing segmentation or burning a lot of test budget. Results on our end have been mixed, although it’s hard to imagine that performance won’t improve over time as TikTok iterates on the offering.

So where does this net out for advertisers in terms of scale and profitability? Despite weaker conversion rates, inventory costs remain low enough for TikTok performance to land within an acceptable ROAS window for many acquisition teams. The more important questions: at what point does it make sense to invest marginal acquisition dollars into TikTok, and how many dollars can it absorb? While there are no universal answers, we’ve seen that advertisers who are successful on TikTok are able to reach somewhere between 5% to 15% of what they spend on Facebook at ROAS parity.

Key Learnings and Takeaways

Marketers looking to slot TikTok into their paid social portfolio need to adapt to a new playbook for campaign management and optimization. At Headlight, we’ve found success after turning a number of Facebook best practices on their head. There are two observations we’ve made about TikTok performance that explain why:

The first seems obvious based on the metrics above, but bears re-emphasis: optimizing TikTok is more often a function of cost arbitrage than value capture. Driving ROAS improvements, in our experience, has largely come from creating efficiencies at the top of the funnel rather than unlocking better retaining and monetizing audiences. This is the opposite of what is often the winning strategy on Facebook, which incentivizes many advertisers to bid aggressively to win inventory against the highest value users. So far as we can tell, the TikTok auction algorithm has yet to incorporate a robust conception of user value. After a number of tests, we found no correlation between CPA bid strength and downstream conversion and retention rates.

The second observation is more nuanced but just as important. It has to do with how TikTok’s ad algorithm uses performance data to gauge competitiveness and meter delivery at the ad set level. What we’ve learned is that, relative to Facebook, TikTok exhibits a much stronger recency bias. As a result of that, ad sets share a few common traits: (1) they benefit less from accumulated historical conversion data, (2) are sensitive to initial conditions, and (3) have a short half life.

To understand how this impacts campaign management, a comparison to Facebook is again illustrative. For the last few years, Facebook advertisers have been incented to consolidate spend into as few segments as possible and minimize disruptive changes to ad sets and campaigns. One reason for this is how Facebook ad sets benefit from amassing conversion event data: the more volume an ad set has, the more confidently Facebook can estimate conversion probability in the auction and the more precisely it can assemble a targeting profile. This accumulation of performance history creates a data tailwind and a compounding advantage over time. All else equal, this creates an incentive for advertisers to aggregate spend where possible and let winners run.

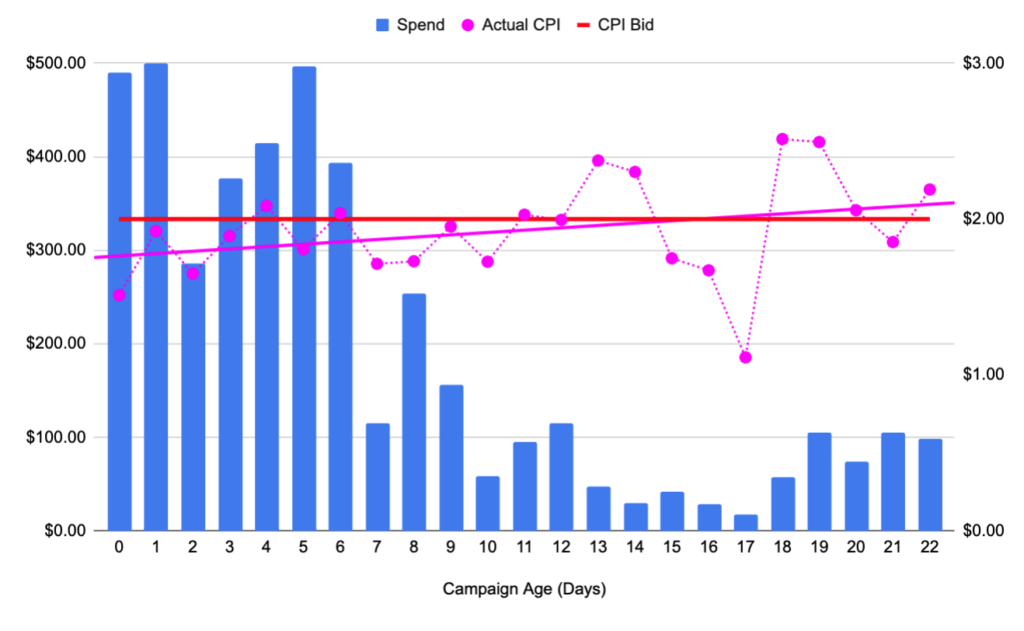

We have yet to see this flywheel on TikTok. On the contrary, high turnover and short ad set lifetimes tend to be the norm. A big driver here is TikTok’s tendency to throttle ad groups very quickly after any period of underperformance. The plot below of spend, target CPI, and actual CPI over a few weeks for a specific ad set we launched is a common scenario:

Here we see the recency bias at work. After missing its target bid for just two days, TikTok throttled delivery by 75%. Even when CPA recovered, delivery did not follow: once an ad set is “marked” as underperforming any kind of resurrection is unlikely. What often works, however, is wiping the slate clean by duplicating and relaunching the ad group. This tactic works at high enough frequency to support the idea of a “dice roll” element to new launches given how TikTok currently calibrates delivery to performance data.

So what are the takeaways for channel and campaign strategy? Given the focus on cost efficiency and the TikTok algorithm’s sensitivity to variance, we suggest adopting a higher volume, “shots on goal” approach to campaign management. All else equal, we see better performance from fanning a given budget over a large number of ad sets at low bids, even at the expense of overlap and consolidated learnings. So far, we have yet to see any kind of performance tax on segmentation.

In terms of campaign structure, we lean into this by factoring most every targeting parameter at the ad set rather than campaign level in order to maximize granularity of control. We even recommend sticking to one creative per ad set: although it’s tempting to do otherwise, TikTok tends to skew all delivery to a single creative very quickly after launch based on a first read of upper funnel metrics. We’ve found that this often passes over creatives that go on to generate breakout downstream performance once launched into their own ad set.

The big downside to this approach is that the heavy ad set volume and turnover leads to ads ops complexity. Fortunately, TikTok has created a solution for tech savvy advertisers through its ads API. At Headlight, we’ve integrated TikTok into our broader channel automation platform in order to manage ad sets programmatically. Over time for a given product, we’ll develop rule sets for bid and budget adjustments based on trailing performance windows using channel and downstream product data. We’ll also use this system to duplicate and relaunch higher performing ad sets where delivery has stalled.

Looking Forward

Given the velocity of both the app’s user growth and the company’s ad product development, it’s hard not to be bullish on TikTok’s prospects to grow wallet share amongst performance advertisers. The shortcomings we’ve outlined above are more so a reflection of kinks you’d expect with a <1yr old beta product than anything inherent to the platform itself. We anticipate that best practices will evolve at a rapid pace over the next year as TikTok builds on its product suite and refines its ad algorithms. These are the three things we’ll be watching out for specifically:

- The broader rollout and improvement of app event optimization products. Nailing this will be key to making the TikTok ads platform more value-driven than cost-driven.

- Improvement of ad set delivery and performance management, especially with creatives. Smoothing the rough edges here will reduce ad ops overhead and improve predictability.

- CPMs and competition. The main question: can TikTok optimize targeting and performance faster than competition narrows its cost advantage relative to Facebook?

About Us

Headlight is a growth marketing firm that helps mobile apps and DTC brands scale customer acquisition. We drive outcomes through hands-on execution, consultative strategy development, and robust technology and analytics. Clients work directly with experienced in-house practitioners on an integrated partnership model that avoids typical agency pitfalls. If you’re interested in learning more, we’d love to hear from you–just give us a shout at info@headlight.co!