Anyone buying media via Meta, Tiktok, and Google in a performance context has sensed a broad tidal shift towards campaign consolidation, creative automation, & broad targeting as a best practice. As a result, conversion based machine learning is stepping into a larger role with asset, audience, and targeting decisions than ever before. By extension, the social ecosystem has seen a removal of discrete controls from the advertiser and the buying team, whether by the introduction of consolidated buying products (Google AC & Meta Advantage+ App Ads), efficiency gain from algorithmically resonant tactics (broad targeting leading to better scalability in TikTok), or removal of previously available granular & deterministic breakdowns & views (Performance Max).

So what’s the problem? A consolidated & broadly targeted channel strategy often creates a dilemma when it comes to increasing reach and scale. Despite broad audiences, optimization algorithms on social platforms often narrow delivery over time to a small subset of your targeted audience based on a number of factors. With consolidated campaigns and automated buying products like Advantage+, we often see advertisers struggle with finding actionable levers when faced with saturating performance. At Headlight, we often see success through experimentation across three fairly straightforward tactics. We’ll walk through each one below with real-world examples. As always, we’d love to hear your feedback–just give us a shout at info@headlight.co!

Tactic 1: Experiment With All Available Campaign Types

In the case of Meta, there can be multiple campaign types that work in tandem within a consolidated strategy. The key is that, generally speaking, we see systematic differences in delivery & targeting between them. For App Advertisers, let’s take Advantage+ App Ads and Standard (legacy/app event optimization) App Campaigns as an example.

Generally, though not universally, these are the differences in delivery by campaign type:

| Advantage+ App Ads | Standard App Event Campaign | |

| CPM | Lower | Higher |

| CTR | Higher | Lower |

| CPI | Lower | Higher |

| Conversion Rate | Lower | Higher |

| Age | Lower | Higher |

| CPA | Comparable | Comparable |

| Summary | Higher volume, lower user cost, lower converting, more “up funnel” | Lower volume, higher user cost, higher converting, more “down funnel” |

Most advertisers are able to achieve relative parity in CPA across both of these methods by tuning daily budgets, and thereby achieve higher reach, lower frequency, and higher diversification in the process.

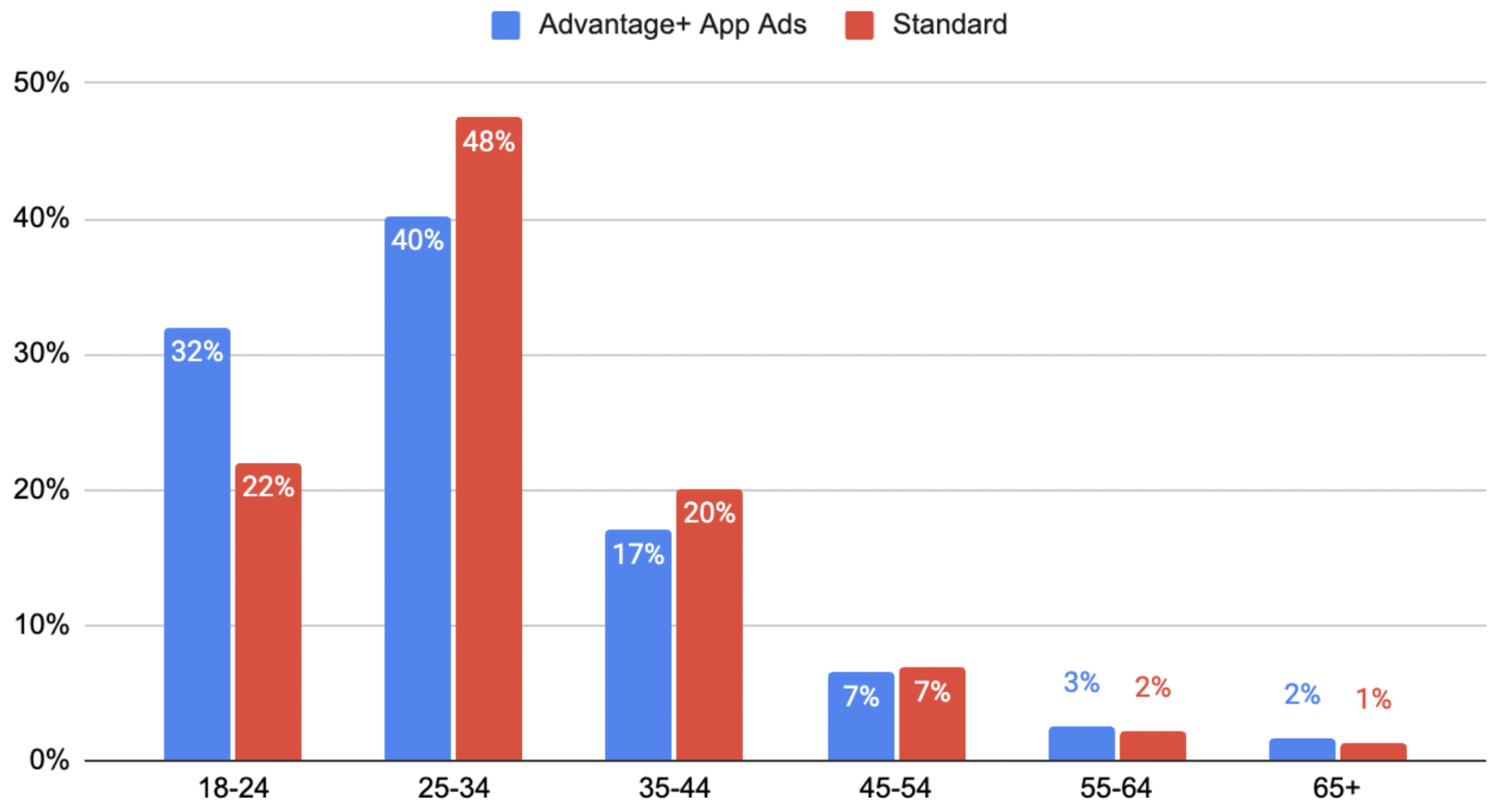

Consider this data from an advertiser running AAA & standard with the same basket of core creatives with broad targeting:

% Clicks by Age

Though CPA between these two campaign types was nearly identical, Advantage+ App Ads skews younger when delivering the same set of creative. Relative scalability between tandem strategies is a separate question that varies by advertiser – usually tested into over the course of weeks to months.

While performance may vary with this method depending on an advertiser’s specific product, market size, auction dynamics and many other factors, campaign type experimentation can be a quick and effective way to expand delivery under a broad & consolidated campaign strategy.

Tactic 2: Isolate > Expand Creative Delivery

“Creative is the new targeting” has been an increasingly common phrase across the advertising ecosystem in the years since iOS 14.5/ATT. This remains largely the case as platforms are relegated to connecting engagement side data (clicks, likes, shares, screen stopping time) with behavioral data collected on the platform side in order to estimate conversion probability – in contrast with the deterministic conversion & revenue feedback loops of the past. Consequently, learning is accumulating across ads independently at some level, which introduces a benefit when an ad is very scaled, but a drawback when a scaled ad becomes a default “preference” of the algorithm in a consolidated campaign. We refer to this as “Incumbency Bias” and have some tips on how to attack it.

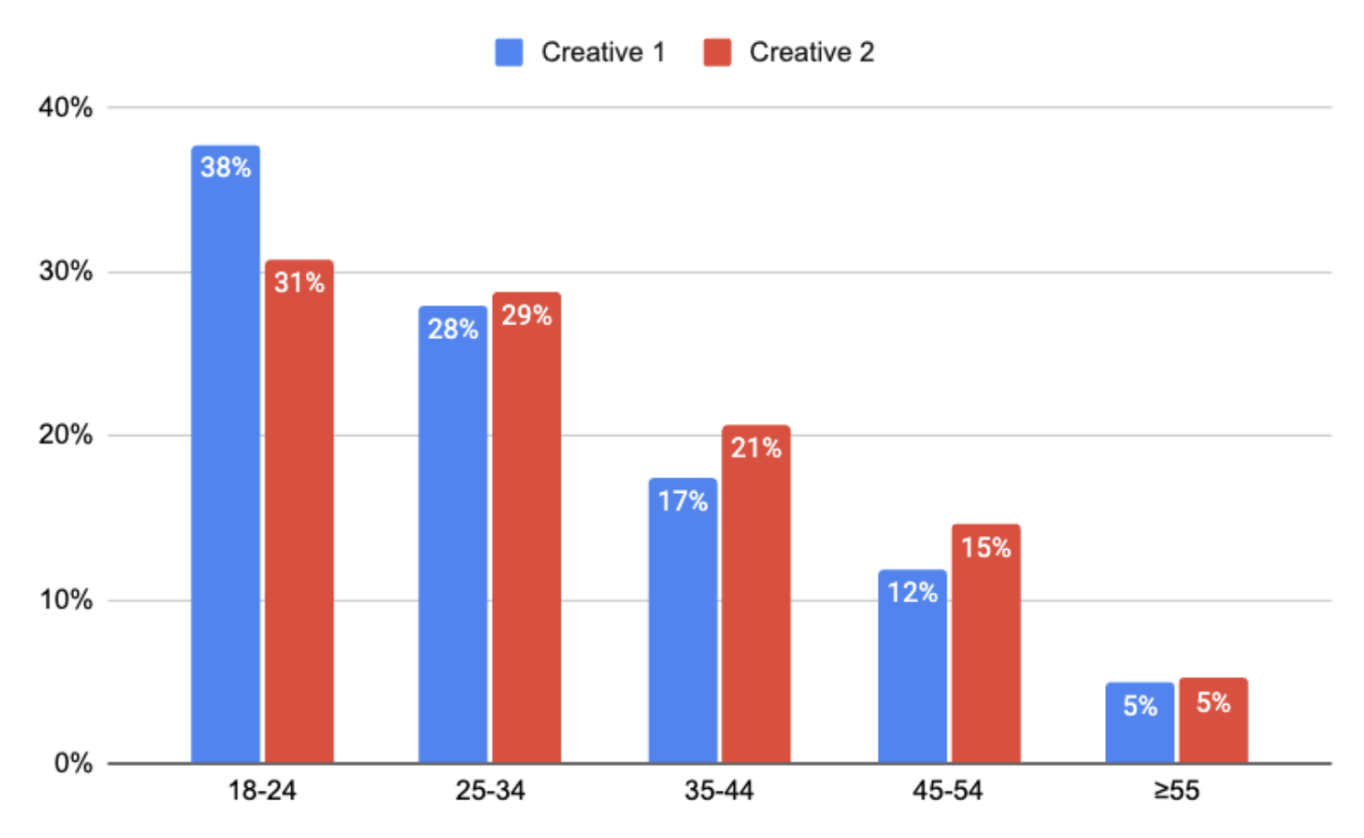

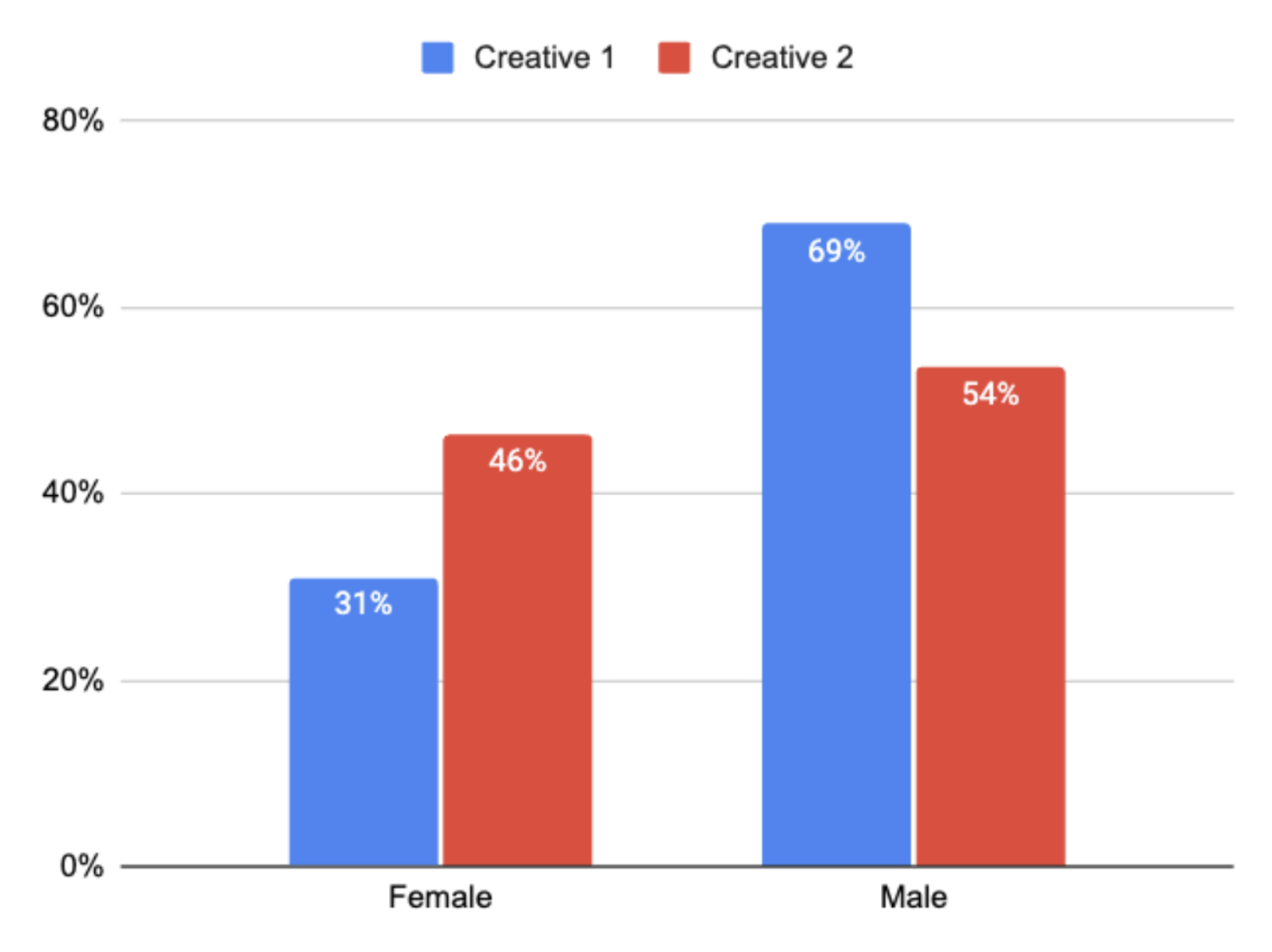

While such a “hero” ad is generally great for the bottom line, there are instances where reach can be limited if budget is spread across a hero ad and a few options. In cases like these, advertisers can expand reach by creating a budget and campaign architecture that distributes budget independently to creatives that appeal to different populations or inventories. Let’s examine this data from two scaled ads on TikTok:

% Clicks by Age & Gender

Like the example covered in Tactic 1, the CPAs between these two creatives are very similar. However, Creative 1 biases Younger and Female while Creative 2 biases Older and Male. By isolating these creatives into separate campaigns with separate budgets and removing allocation control from the algorithm, we were able to scale higher with a more diversified demographic mixture. This is particularly important on social channels like TikTok where creative performance is more susceptible to acute trends and have shorter shelf lives. All things equal it’s better to have two scaled creatives than one.

An insight like this also provides an opportunity to associate and overlay lifecycle information collected product-side. A classic example of this is associating a SKAD event with downstream conversion that is not captured in the typical SKAD window (say in the case of a trial to subscription product). Associating conversion rates with demographic differences by creative will provide a deeper ROAS picture than SKAD can provide alone.

Structuring campaigns and budgets in a way that isolates & scales creatives that appeal to different demographics can increase overall reach and diversify impression share for advertisers.

Tactic 3: Expand Platform Coverage

App Advertisers have long been subject to the 30% In-App Purchase fees required by Google Play and the App Store. In deference / response to pending litigation challenging these fees as an antitrust practice, advertisers have increasingly moved acquisition to web funnels, or rebuilt products entirely on Web to skirt such fees. For an app advertiser, such a transition also opens the ecosystem of web acquisition advertising products which tend to be less consolidated within networks, as well as more measurable due to information contained in the advertiser-owned clickstream.

An added, and less discussed, benefit is that the reach of web advertising products in some cases materially diverges from App advertising products when all elements across both campaigns are equal.

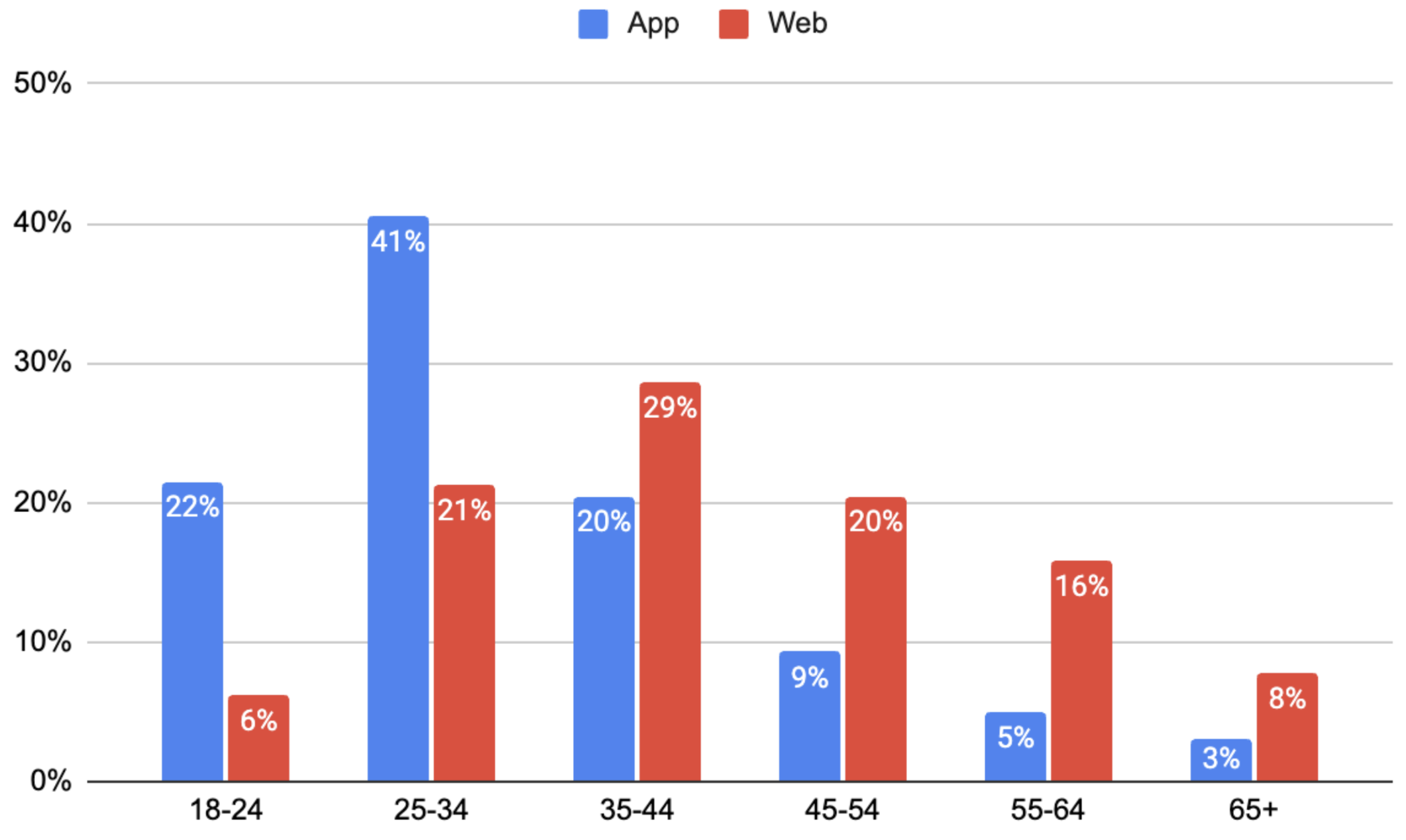

Let’s take a look at a cross-platform advertiser who is running an identical creative set to a broad audience in two Meta campaigns, with the only difference being destination of app or web.

% Conversions by Age Bracket

After controlling for the audience & creative variables, the Web destination skewed significantly older. By merely sending traffic to a web destination in a web campaign, this advertiser was able to both expand + diversify reach and unlock delivery to an older audience. As in the examples covered in Tactics 1 & 2, the CPA between these strategies was comparable and these campaigns worked in tandem.

In summary, many advertisers are left backed into a corner and unable to innovate when leveraging the prominent, consolidated campaign products of the social platforms. While many other strategies can break advertisers out of such a rut, we have covered three basic ones advertisers can try with little effort today. If you’d like to get in touch with Headlight, feel free to reach out by emailing info@headlight.co