Quick Read

- The rollout of privacy regulations have severely impacted the precision and clarity of audience delineations. This especially impacts businesses whose segments cover a large spectrum of LTVs, such as eCommerce.

- Meta’s increasingly automated toolset has yielded gaps which, if not properly monitored, can severely degrade the platform’s power to drive incremental new business.

- In this article we walk through five analyses we routinely employ for our partners to ensure our prospecting media continues to drive bottom-line impact. These include hygiene checks on attribution & optimization signal, as well as tips for using deeper metrics to validate the channel’s incremental nature.

- Headlight’s team of experts are offering a free strategic Audit Session across Growth, Creative & Analytics – a unique opportunity for brands to learn more about how to scale spend with incrementality in mind.

Introduction

Apple’s release of ATT / iOS 14.5 in April 2021 marked a pivotal moment in the ability to deterministically track users from click/impression through to install, app actions, and eventually LTV. Less discussed is the impact that ATT had on the fidelity of advertiser curated audiences across the Meta ecosystem and indeed across all platforms. In short, iOS users must be ATT opted in on Facebook and/or Instagram to be included in an exclusion list. Advertisers are subject to this limitation regardless of a campaign’s target destination (App Store or Website) and – given the vast majority of Meta’s impressions occur on mobile devices – all advertisers have significantly less control over how they can define and target existing vs. new user buckets.

This is particularly problematic for eComm advertisers who can have many customer segments with a broad spectrum of value (existing customers, new customers, high AOV customers, repeat buyers). What’s left for today’s advertiser is a more limited toolset for targeting these buckets explicitly – as well as a heavier lift in evaluating the impact of paid media. Today we’re going to walk through some easy Meta platform signs that may indicate (though not always) your campaigns are not as incremental as you think.

1. High View Through % on Meta

Throughout the past 18 months Meta has gradually re-introduced the ability to break down conversion counts by attribution type (this feature was on hiatus post iOS 14.5). Consequently, an advertiser can look at what count of conversions are explained by 1 + 7 Day Click & View attribution from their campaigns. This is a treasure trove of data that can directly relate to incrementality.

To provide a benchmark towards this, when an advertiser’s conversions are ~50%+ explained by VTA this is a clear signal that Meta spend might be overly allocated to existing users. Consider the following example:

- User is in the market for holiday socks and visits several advertiser websites to browse for a design that wows them

- User gets served many ads from a variety of sock companies, including one from a brand “Happy Sock” they purchased some product from last year around the same time

- Five days later, under decision paralysis and the deadline of an impending holiday party, the user buys another pair from “Happy Sock” since they are familiar with the brand and already had a positive customer experience

In such a case, the ad could have been served by a Happy Sock conversions campaign, in which case that ad would have gotten credit for the sale, while potentially not having driven it causally.

When an advertiser's conversions are ~50%+ explained by VTA this is a clear signal that Meta spend might be overly allocated to existing users.

When an advertiser's conversions are ~50%+ explained by VTA this is a clear signal that Meta spend might be overly allocated to existing users.

Now, this certainly isn’t to say that all campaigns with high view-through are inherently not incremental. There are many cases where impressions alone can impact consumer behavior, a few examples:

- Ads for sensitive products the user doesn’t want to interact with directly

- Ads that influence recency bias for repeat purchasers (who have high LTVs as the brand remains top of mind)

- Ads that re-engage an existing user with a product that has high seasonal cyclicality in usage (e.g. education products that are relevant at certain points in the academic year, or tax products in April)

- A temporary discount sale designed for existing / familiar customers

2. Optimization Event On Prospecting Campaigns Fires for Existing Users

As noted in 3 Ways to Increase Reach with a Consolidated Campaign Strategy on Social:

“Anyone buying media via Meta, Tiktok, and Google in a performance context has sensed a broad tidal shift towards campaign consolidation, creative automation, & broad targeting as a best practice. As a result, conversion based machine learning is stepping into a larger role with asset, audience, and targeting decisions than ever before.”

Since machine learning is playing an increasing role in paid social, it’s important to calibrate your signal properly back to the platform. Lower exclusion list viability makes this even more of a pressing issue.

Consider the advertiser running a prospecting campaign on the “Purchase” event. In the case that a large customer base already exists, and this Purchase event fires for repeat purchasers, the Meta algorithm is going to do what it does best and find users who are going to fire that event for the lowest price. In some cases, though, that Purchase signal can bias a campaign towards existing users and away from new ones since they are already familiar with the brand and presumably less expensive to convert for a second / third / fourth time.

One way to check this is to look at the click stream data – who are these buyers? Are they new users or existing users? How long have they been customers? A proper event hygiene protocol opens up the opportunity for advertisers to create competitive advantage.

Since machine learning is playing an increasing role in paid social, it's important to calibrate your signal properly back to the platform. Lower exclusion list viability makes this even more of a pressing issue.

Since machine learning is playing an increasing role in paid social, it's important to calibrate your signal properly back to the platform. Lower exclusion list viability makes this even more of a pressing issue.

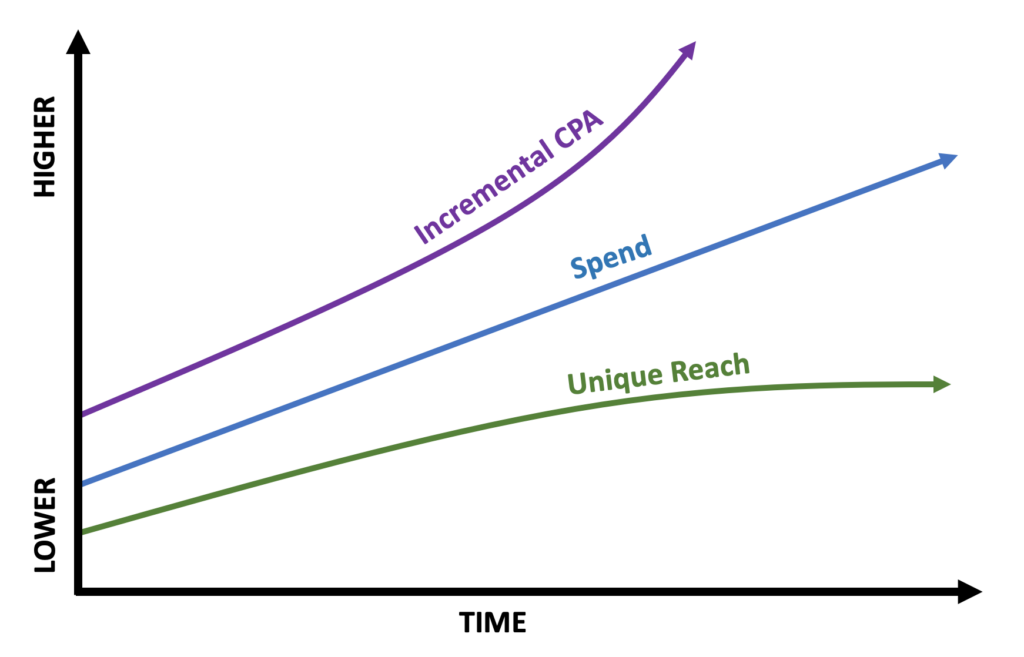

3. You Can’t Scale Reach / Frequency is High

We combined these two into one “sign” as they are interrelated. You’ve probably seen this before: an advertiser is increasing spend and trying to scale during a critical sale period, but all that seems to happen is:

- CPM Increases ⇑

- Frequency Increases ⇑

- CTR Declines ⇓

- Cost Per Purchase Increases ⇑

Why? In many such cases what’s happening here is the marginal campaign budget is impacting Impressions, but not reach (a measure of impression uniqueness). Consequently, spend, impressions and frequency rise, but reach stays relatively flat. This means the extra spend isn’t actually getting the message out to net new users, but rather increasing the ads seen by users who are already familiar with the ads and the brand.

If this situation sounds familiar, we’d recommend keeping tabs on this metric: RPM = (Spend / [Reach/1000)) – think of this as a “Unique” CPM. All else equal, you want to be scaling reach as well as conversion counts to ensure sustained incrementality.

4. Retargeting Explains a High % of Budget

This is an easy one – retargeting should no longer explain a high % of budget for a few reasons that mostly relate to ATT & customer list fidelity:

- Exclusion lists are incomplete so campaigns are really only targeting a small % of the total audience size (another interplay you can verify by looking at retargeting reach relative to the total audience size)

- Exclusion lists are incomplete so prospecting campaigns are also serving a retargeting function.

- (More of a recent platform observation): Meta campaigns targeting lower audience sizes tend to drive CPM up.

To help quantify this, if retargeting is over 20% of your budget it is worthy of a deeper look. However, as is the case with many of these platform signs, this alone isn’t necessarily an indicator of incrementality issues.

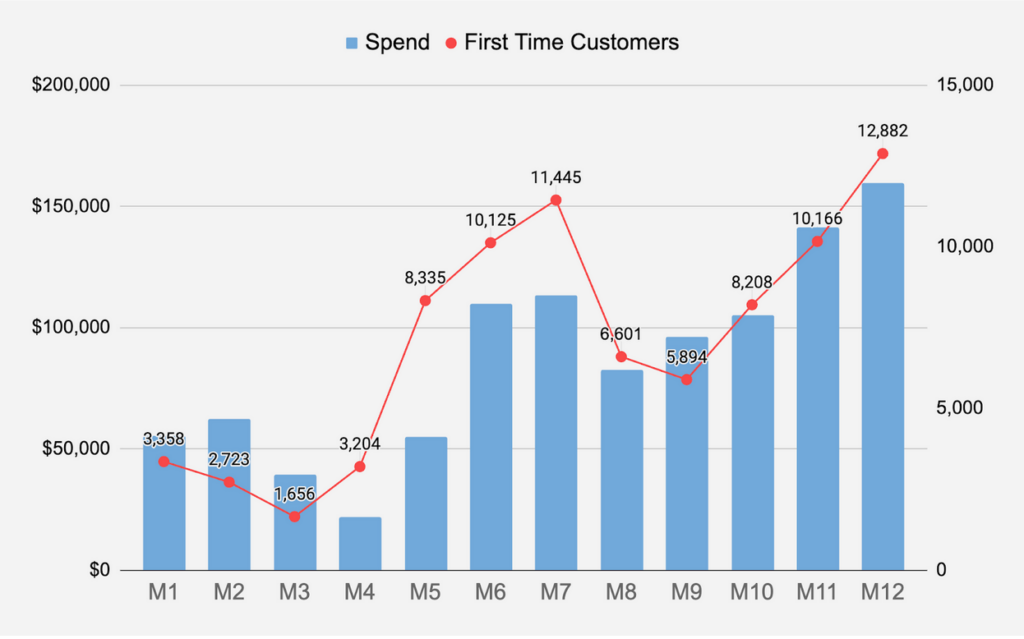

5. Prospecting Spend is Uncorrelated with New Customers

A simple check that most eComm advertisers can do that may illustrate the root of the issue quickly is to compare Meta prospecting spend (as-in, earmarked for new customer acquisition) against the count of New Users across a given time period. If these values have low correlation, that is a clear sign that prospecting marketing spend is not leading to prospecting marketing results.

To help illustrate this, below is an example from one of Headlight’s eComm clients:

A properly calibrated and configured campaign setup and strategy should lead to a tight correlation between prospecting spend and business impact (net new customers).

A properly calibrated and configured campaign setup and strategy should lead to a tight correlation between prospecting spend and business impact (net new customers).

A properly calibrated and configured campaign setup and strategy should lead to a tight correlation between prospecting spend and business impact (net new customers).

So What Do We Do About It?

Stay tuned for a follow-up piece on Meta platform tactics that maximize incrementality – but for advertisers who fit one or more of these conditions, unfortunately there isn’t always a clear & easy answer as to what to do. The first step is usually external verification of some type: these advertisers may benefit from running a conversion lift study via Meta (the only way to ensure consistent test & control groups throughout a test period). Alternatively, running an incrementality or reverse match-market test of their own design is an option.

The prevalence of Issues like these is why measurement is a centerpiece of what we do here @ Headlight. If you are seeing one of more of these signs and don’t know how to address them, reach out to info@headlight.co.

Headlight’s team of experts are offering a free strategic Audit Session across Growth, Creative & Analytics – a unique opportunity for brands to learn more about how to scale spend with incrementality in mind.